Fighting Fraud with AI Using AWS Cloud Solutions

Understanding the Concept of Fraud in the Digital Age

Fraud has dramatically evolved with the rise of the internet and digital technologies. In the digital age, fraud refers not only to traditional schemes but also to sophisticated methods that exploit technological vulnerabilities. This conceptual shift necessitates an adaptive approach to fraud prevention and detection, leveraging advanced technologies to safeguard personal and financial information.

Digital fraud encompasses a wide range of deceitful activities, including identity theft, credit card fraud, phishing attacks, and more. Criminals increasingly use online platforms to target vulnerable individuals and businesses, often leading to substantial financial losses and reputational damage.

Understanding fraud in the digital landscape requires recognition of how fraudsters operate and the tools they employ. The accessibility of information and anonymity provided by the internet empower these criminals to devise intricate schemes, requiring a comprehensive strategy to combat fraud effectively.

The Evolution of Fraudulent Activities

Historically, fraud was primarily conducted through face-to-face interactions, involving methods like check forgery and mail fraud. However, with technological advancement, these methods have transitioned into the digital realm, where fraud is not constrained by geographical barriers.

The evolution of fraudulent activities primarily hinges on the progression of technology. For instance, the introduction of online banking has made financial information more accessible to fraudsters. Moreover, the rise of social media platforms has enabled criminals to harvest personal information to facilitate identity theft.

As technology continues to evolve, so too does the sophistication of fraudulent activities, which creates a constant need for enhanced security measures to protect against emerging threats. Additionally, the advent of artificial intelligence and machine learning has given rise to new forms of fraud, such as deepfake technology, which can create convincing audio and video impersonations. This not only complicates the detection of fraud but also raises ethical questions about the authenticity of digital content.

The Impact of Fraud on Businesses and Individuals

The ramifications of fraud extend beyond simple financial losses, affecting both individuals and organizations on various levels. For businesses, the consequences can be devastating, leading to diminished customer trust, increased operational costs, and potential legal ramifications.

Individuals, on the other hand, bear the brunt of identity theft, losing not only money but also their creditworthiness and peace of mind. Victims often confront lengthy recovery processes involving credit repair and, in some cases, significant emotional distress. The psychological toll can be profound, as individuals grapple with feelings of violation and vulnerability, which can linger long after the financial aspects have been resolved.

In a broader economic context, the cumulative effects of fraud can impede market growth, increasing costs for businesses which, in turn, raise prices for consumers. Hence, addressing fraud is crucial for fostering a secure and trustworthy commercial environment. Furthermore, the increasing sophistication of fraud tactics necessitates ongoing education and awareness programs for both consumers and businesses. By fostering a culture of vigilance and proactive measures, stakeholders can better equip themselves to recognize and respond to potential threats, ultimately contributing to a more resilient digital economy.

The Role of Artificial Intelligence in Fraud Detection

Artificial Intelligence (AI) plays a critical role in the detection and prevention of fraud in today’s technologically advanced landscape. By automating the identification of suspicious activities, AI allows organizations to enhance their fraud detection capabilities significantly.

The evolving nature of fraud demands that businesses employ AI-driven solutions that can analyze vast amounts of data in real-time, identifying anomalies that might indicate fraudulent actions. Through machine learning and predictive analytics, AI systems become more adept at recognizing patterns that human analysts might overlook.

How AI Transforms Fraud Detection

AI is reshaping fraud detection by enabling organizations to transition from reactive to proactive measures. Traditional approaches often involve manual reviews of transactions, which can be time-consuming and ineffective in predicting future fraud attempts.

With AI, organizations can harness real-time data analysis and pattern recognition. This allows for immediate alerts on suspicious behaviors, minimizing the window of vulnerability for potential fraud incidents. Enhanced algorithms can generate insights that inform decision-making processes, streamlining detection and prevention efforts.

Moreover, AI systems can evolve based on the data they process, continuously improving detection accuracy over time, thus reducing false positives and enhancing user experience.

The Mechanism of AI in Identifying Fraud Patterns

The functionality of AI in identifying fraud patterns relies on machine learning algorithms that analyze historical transaction data to establish a baseline of normal behavior. Once this baseline is set, the system can flag anomalies that deviate from established patterns.

Additionally, AI systems utilize clustering techniques to categorize transactions based on similarities, helping to identify previously unseen fraud patterns. These mechanisms enable the detection of sophisticated scams that may not fit typical fraudulent behavior, enhancing overall security.

Through these advanced methodologies, organizations can stay ahead of evolving fraud tactics, ensuring robust protection against financial theft.

An Overview of AWS Cloud Solutions

Amazon Web Services (AWS) provides a suite of cloud solutions tailored to enhance the security and operational efficiency of organizations. These services allow organizations to leverage the scalability, reliability, and flexibility of cloud computing, making them an ideal choice for fraud detection applications.

By utilizing AWS, organizations can integrate powerful data processing capabilities that enable them to handle large volumes of transactions efficiently. This is particularly valuable in industries like finance, where real-time fraud detection is paramount.

Key Features of AWS Cloud Solutions

- Scalability: AWS allows companies to scale their operations up or down based on demand without extensive infrastructure investments.

- Security: With robust security features, AWS provides a strong framework for protecting sensitive data against breaches.

- Cost-Effectiveness: AWS services are pay-as-you-go, helping organizations reduce operational costs while maintaining top-tier performance.

- Ease of Integration: AWS’s diverse suite of tools and services can easily integrate with existing systems, enhancing overall operational synergy.

The Benefits of Using AWS for Fraud Detection

Implementing fraud detection solutions on AWS offers several advantages. Firstly, the platform’s vast computational resources allow organizations to analyze large datasets quickly, improving the accuracy and speed of fraud detection processes.

Additionally, AWS’s advanced machine learning services empower organizations to build models that predict fraudulent activities more effectively. These models can evolve and adapt, ensuring ongoing effectiveness against new fraud tactics.

AWS also offers comprehensive monitoring and reporting tools that help organizations maintain compliance with industry regulations while ensuring that their fraud detection initiatives are transparent and accountable.

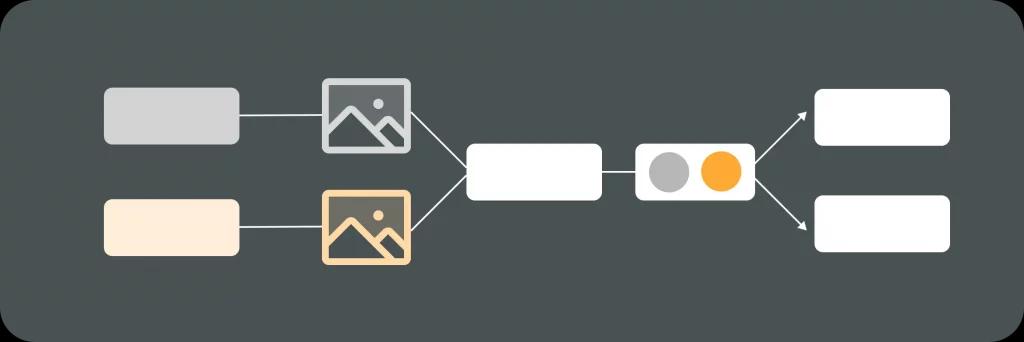

Implementing AI with AWS for Fraud Detection

To combat fraud effectively, companies must implement AI solutions seamlessly within the AWS framework. This integration is vital for maximizing both technological advantages—automation and data processing capabilities.

The process involves several steps, ensuring that organizations can utilize AI efficiently while harnessing the full potential of AWS services.

Steps to Integrate AI into AWS

- Assess Your Needs: Identify specific fraud detection goals and determine the data sources required.

- Choose the Right Tools: Select appropriate AWS services such as Amazon SageMaker for machine learning model development.

- Data Preparation: Clean and preprocess the data for accurate analysis.

- Model Development: Build and train machine learning models that can detect fraudulent patterns.

- Testing and Validation: Rigorously test the model to ensure accuracy and effectiveness before deployment.

- Deployment: Implement the model within the cloud environment and continuously monitor its performance.

Customizing AWS Cloud Solutions for Optimal Fraud Detection

Customization is key to optimizing fraud detection solutions on AWS. Organizations can tailor their setups based on specific operational needs, ensuring they address the unique challenges they face in fraud prevention.

This customization extends to adjusting machine learning models, configuring alerts for suspicious activities, and integrating additional data sources that are relevant to the organization’s specific fraud landscape.

By leveraging AWS’s flexibility, companies can create a tailored fraud detection environment that evolves with emerging trends and threats, ensuring continued effectiveness and organizational resilience.

Future Trends in AI and Cloud-Based Fraud Detection

The intersection of AI and cloud technology is set to redefine the landscape of fraud detection. As advancements in machine learning and data analytics continue, organizations must stay ahead of these trends to maintain robust defenses against fraud.

Cloud-based solutions will remain at the forefront of these advancements, providing necessary infrastructure and resources to scale fraud detection efforts efficiently.

Predictions for AI and Cloud Technology in Fraud Detection

Experts predict that the convergence of AI and cloud technology will lead to more sophisticated fraud detection systems, capable of identifying complex fraud patterns with unprecedented speed and accuracy. Additionally, enhanced collaboration tools within the cloud will allow organizations to share insights and learnings, creating a more interconnected approach to fighting fraud.

Furthermore, advances in natural language processing and sentiment analysis are expected to improve the detection of social engineering attacks, equipping organizations with tools to combat increasingly sophisticated tactics.

Preparing for the Future of Fraud Detection with AI and AWS

To effectively prepare for the evolving landscape of fraud detection, organizations must invest in training their workforce on AI and AWS technologies. Continuous learning and adaptation will be essential to understand and leverage these tools effectively.

Additionally, organizations should adopt agile methodologies, allowing them to pivot and respond to new threats promptly. This adaptability will be critical as fraudsters find new methods to exploit vulnerabilities.

In conclusion, as fraud continues to evolve in complexity, the integration of AI with AWS cloud solutions stands vital. By understanding the landscape, utilizing advanced technologies, and fostering a culture of security awareness, organizations can position themselves to fight fraud effectively in the digital age.

Your DevOps Guide: Essential Reads for Teams of All Sizes

Elevate Your Business with Premier DevOps Solutions. Stay ahead in the fast-paced world of technology with our professional DevOps services. Subscribe to learn how we can transform your business operations, enhance efficiency, and drive innovation.